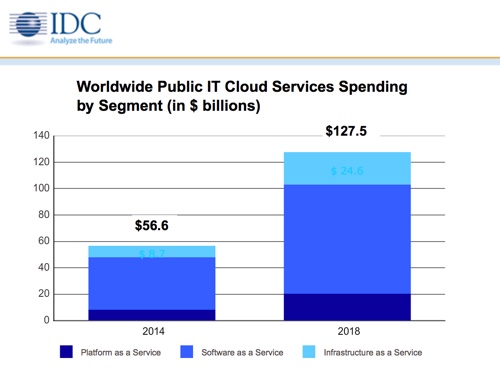

IDC: public IT cloud spending with reach $127 billion in 2018

Public IT cloud services spending will reach US$56.6 billion in 2014 and grow to more than $127 billion in 2018, according to a new forecast from International Data Corporation (www.idc.com), which is about six times the rate of growth for the overall IT market. In 2018, public IT cloud services will account for more than half of worldwide software, server, and storage spending growth.

Among the factors driving public IT cloud services growth is the adoption of "cloud first" strategies by both IT vendors expanding their offerings and IT buyers implementing new solutions. More importantly, IDC believes the cloud services market is now entering an "innovation stage" that will produce an explosion of new solutions and value creation on top of the cloud.

Many of these new solutions will be in industry-focused platforms with their own innovation communities, which will reshape not only how companies operate their IT, but also how they compete in their own industry. As the number of applications and use cases explode, cloud services will reach into almost every B2B and consumer services marketplace.

"Over the next four to five years, IDC expects the community of developers to triple and to create a ten-fold increase in the number of new cloud-based solutions," says Frank Gens, senior vice president and chief analyst at IDC. "Many of these solutions will become more strategic than traditional IT has ever been. At the same time, there will be unprecedented competition and consolidation among the leading cloud providers. This combination of explosive innovation and intense competition will make the next several years a pivotal period for current and aspiring IT market leaders."

IDC expects software as a service (SaaS) will continue to dominate public IT cloud services spending, accounting for 70% of 2014 cloud services expenditures. This is largely because most customer demand is at the application level. The second largest public IT cloud services category will be infrastructure as a service (IaaS), boosted by cloud storage's 31% CAGR [compound annual growth rate] over the forecast period. Platform as a service (PaaS) and cloud storage services will be the fastest growing categories, driven by major upticks in developer cloud services adoption and big data-driven solutions, respectively.